Years after the Mt Gox fiasco a group of creditors of the defunct bitcoin exchange Mt. Gox are preparing to claim for Bitcoin and Bitcoin Cash repayments following a court’s decision in June.

Lawyers of several Mt. Gox creditors filed a petition in November to move Mt. Gox out of bankruptcy and into civil rehabilitation. Last Thursday, 2nd August 2018, they published an updated proposal for the process.

The lawyers released an initial basic policy for the rehabilitation on June 29 2018, just a week after a court in Tokyo approved the creditors’ petition for civil rehabilitation entered late last year.

The policy stated in June that it would be “appropriate” to repay creditors who deposited BTC and BCH with Mt. Gox in the same cryptocurrencies instead of cash.

In the latest update, the lawyers further asserted that it would be desirable that these “BTC and BCH be sent to exchanges in which many creditors have accounts or can open accounts easily,” adding:

“We are of the opinion that most of the assets, including approximately 166,000 BTC and 168,000 of BCH and other derivatives currently held by Mt. Gox, should be paid to creditors at the time of the first payment.”

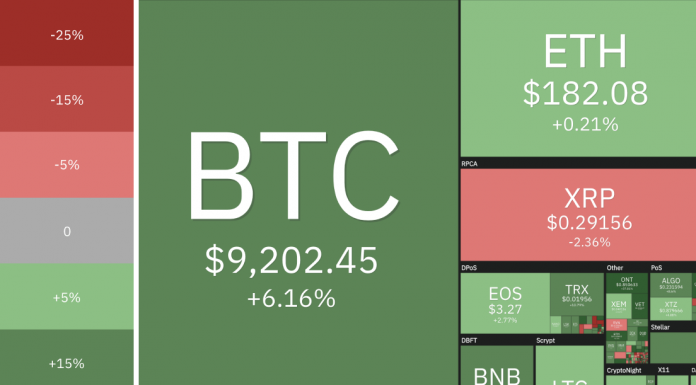

At current prices these assets are worth over US$1.2 billion.

If the rehabilitation plan is approved by the Japanese court in February 2019 then it is expected that the first payment would start in May or June 2019. With fiat creditors being paid first.

Mt. Gox, once the world’s largest bitcoin exchange by trading volume, declared bankruptcy in 2014 after over 744,000 BTC were stolen. Subsequently, creditors went into a years-long process in a bid to retrieve their trapped funds. A perfect example of why sometimes bankruptcy is not always the best course of action.

Mt. Gox’s trustee was then holding 202,195 bitcoins and then liquidated over 30,000 of them into cash in March 2018. The court’s approval of the civil rehabilitation petition means that Mt. Gox will no longer need to liquidate any BTC or BCH assets.

It is yet to seen how creditors would react, should the price of Bitcoin fall sharply back below the US$1000 levels.