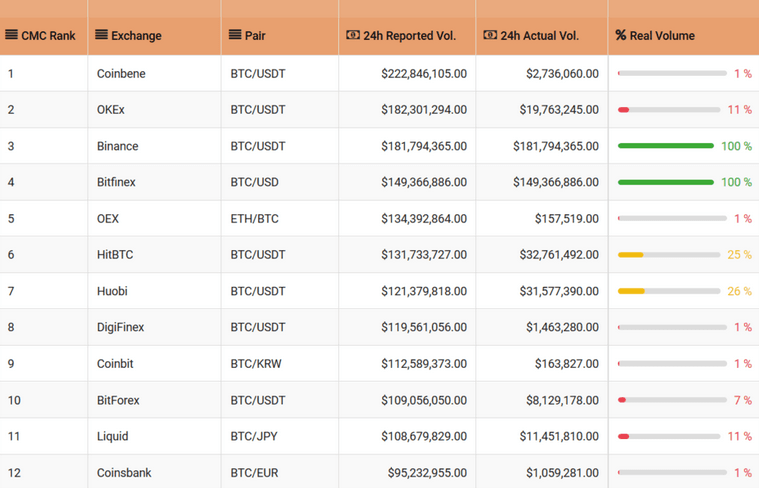

A recent report by Blockchain Transparency Institute (BTI) reveals that most of the Cryptocurrency exchanges are faking 87% of all the trading volumes across the top 25 exchanges.

Coinmarketcap is not a reliable source of information to measure trading volumes on various exchanges. This is evident from the data presented in the report, out of the top 25 exchanges on Coinmarketcap a shocking 11 of them have over 99% of their volume faked, 12 of them including major exchanges like Huobi and OKEx are faking over 75% of the trading volumes.

Exchanges are involved in wash trading. This is when an investor buys and sells to himself to create the illusion of trading activity on an exchange. It is illegal in most jurisdictions, although crypto being unregulated means that users can get away with it.

Most of these exchanges are not even regulated, some of them are even located in places like the Cayman Islands and Gibraltar where there are effectively no regulations.

Image Source: blockchaintransparency.org

Binance and Bitfinex Come out Clean

The only 2 exchanges out of the top 25 to are reported to be clean, these are Malta based Binance and British Virgin Island-based Bitfinex.

Major US exchanges like Coinbase, Poloniex and Kraken did not even make it to the top 25 list due to low but real volumes. Most of the US exchanges are majorly fiat on ramps and do not indulge in wash trading.

The report goes to state that many of the exchanges which fake volumes charge on average $50,000 in listing fees for new tokens. As such they could be profiting from the fake volume.

BTI will soon release their Initial Investor Security Report which will highlight current exchange security measures and ways in which the space can make both current and future investors feel safer with their funds. Lets see what they find out.

Let us know your thoughts in the comments below.